Building Europe’s Energy Security on a Battery Backbone

Challenges and opportunities in reshoring a competitive European battery value chain

Written by Walter D. Johnsen, PhD

on March 25, 2025

European Battery Manufacturers are Struggling

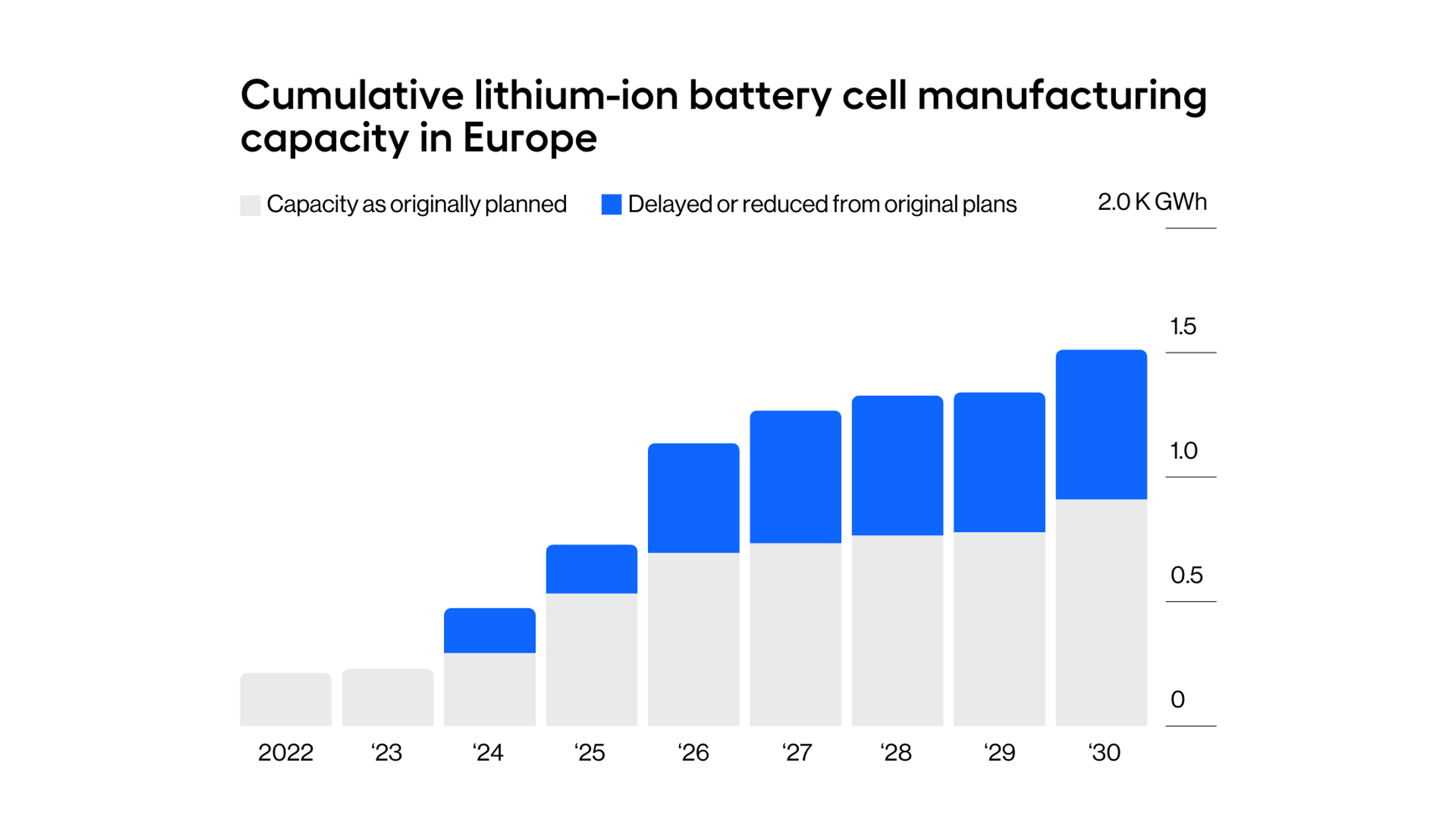

2024 was a reckoning for Western battery manufacturers. Northvolt lost a $ 2 B contract with BMW, its joint venture to build a gigafactory with Volvo fell apart, and most recently Northvolt declared bankruptcy in Sweden. ACC - a joint venture between Stellantis, Saft, and Mercedes-Benz - announced a pause to add manufacturing capacity in Germany and Italy. More recently, Freyr, iM3NY, and Kore abandoned their respective plans to build gigafactories in the US. It is clear that the nascent Western battery manufacturing industry is under pressure from fierce competition from China and flattening growth.

Beyond market dynamics, batteries require complex manufacturing processes and yet are subject to commodity pricing.

The typical production process to manufacture batteries requires over 14 steps and involves specialised equipment. Ensuring consistent quality across the 14 steps has been acutely challenging to manufacturers, and responsible for costly delays.

On top of quality control, European manufacturers seem unfamiliar with the actual manufacturing equipment. In fact, most equipment found in European battery factories were developed by and purchased from Chinese manufacturers like CATL. One could argue that the knowledge transfer on how to operate and service the equipment was literally lost in translation.

Finally, European manufacturers faced challenges in recruiting talent to operate battery factories. The pressure was so acute that companies developed internal battery manufacturing skill development programs, such as Northvolt University.

Emergent Technologies Offer a Solution

There are several innovations Western companies could leverage to simplify battery manufacturing and produce cost-competitive batteries.

First, new technologies to detect defects in real time will lower losses due to poor quality control. Companies like Voltaiq and TWAICE have synergized AI monitoring platforms with sensors to do just that. Both companies have engaged in strategic partnerships with manufacturers to optimize manufacturing and decrease the prevalence of defects.

Second, new process steps could allow for leaner manufacturing. For example, AM, 24M Batteries, and Tesla are developing dry coating systems that remove the need for drying, formulation, and aging steps of battery production - steps responsible for over 70% of the cost of production. However, dry coating manufacturing faces technical challenges including inconsistent coating application and a limit to how thin the layers can be. The floor-to-coating thickness limits the power density of the resulting batteries, preventing their use in technologies other than stationary energy storage.

Third, batteries could be re-designed from scratch to enable manufacturing ease and repurpose Western technologies.

We’re Developing a New Way to Manufacture Batteries

At Marble, we have been obsessed with option 3. Together with a battery industry veteran, we have developed a technology to manufacture batteries at 50-70% of the cost with just 10% of the embodied carbon emissions.

Our secret: we did not limit ourselves to conventional battery cell designs.

Now, we are looking for a CEO to join this stellar early-stage team and provide a disruptive force in the battery manufacturing ecosystem.

If interested, take a look at our job description and apply!

Apply now!